Searching for Stability

By Beth Mattson-Teig | Spring 2022

Everyone is feeling the pinch of the supply chain disruption, whether they are walking by empty store shelves or waiting weeks for a part in a much-needed auto repair. For commercial real estate professionals, that supply chain disruption is creating both challenges and opportunities.

The big question is just how long supply chain disruptions will last — and views from experts are mixed, with estimates ranging from 12 months to more than three years. Although the cargo ships stacked up outside the ports of Los Angeles and Long Beach have become symbolic of the supply chain crisis, problems with the movement of goods go beyond a single bottleneck. “We have had structural things that were happening before COVID-19 that were heading us toward supply chain disruption,” says K.C. Conway, CCIM, MAI, CRE, chief economist of the CCIM Institute and principal and co-founder of Red Shoe Economics.

The pandemic also highlighted the dependence the U.S. has on imports from Asia and the dominant role China plays in the global world of manufacturing. “When China shut down, effectively because of COVID-19, that was the traffic accident on the 405 that backed everything up,” says Richard Thompson, international director, Supply Chain & Logistics Solutions, Americas at JLL. Even after they cleared the wreckage and started to reopen, there was a bullwhip effect on the rest of the world, he adds, as demand disruptions traveled throughout the supply chain, from end user to manufacturer. Global supply chains are still dealing with the enormous ripple effects, including large queues of ships at the ports.

Even in otherwise normal conditions, supply chains would be strained by the surge in online sales that occurred at the start of the pandemic. Those companies that were embracing just-in-time supply chain strategies were stuck with low inventory and empty warehouses when e-commerce exploded. “It’s not that the ports didn’t work or the logistics infrastructure wasn’t working — they just got overwhelmed,” Conway says.

At the same time, U.S. supply chains were burdened by structural issues that included the country’s aging and inadequate transportation infrastructure, as well as new trucking regulations passed in 2018. The new truck driving logbook rules were put in place to improve safety by mandating rest breaks and limiting behind-the-wheel time for truckers — but wiped out about 25 percent of the trucking fleet capacity, notes Conway. California’s regulations, such as a union workforce and restrictions on trucking hours related to air quality, were other issues that exacerbated the challenges. “All of those things came together in a perfect storm, and to unwind all of those things is going to take some rethinking,” he says.

Bringing balance back to supply chains is creating both direct and indirect impacts for industry practitioners and the commercial real estate sector. Notably, changes in supply chain strategies are influencing location decisions for logistics companies, warehouse/distribution, fulfillment centers, and manufacturing. In some cases, those site selection decisions are redirecting job and population growth, which in turn drives demand and investment opportunities across property types. CRE professionals also are tasked with helping clients navigate delays in building materials caused by supply chain disruption that creates delays and contributes to higher costs for ground-up construction, renovation, and build-out of tenant spaces.

In addition, supply chain disruption poses yet another hurdle for retailers that have already been hard hit by the pandemic by adding costs and putting a dent in sales. In some cases, it is difficult for retailers to get certain product on shelves, especially the right seasonal products in stock at the right time. After a lull in retailer store closings in 2020 and 2021, there could be more shakeout ahead in 2023, notes Conway. “I think the second shoe to drop is coming later this year or early next year, and it could be the final straw that breaks the back for some retailers,” he says.

New Location Strategies

Companies are in the process of remaking supply chains from those that rely on the West Coast as a through-put of goods, to a more north-south model. For industry pros helping their clients with location and investment decisions, they need to focus on the “Golden Triangle” section of the country, notes Conway. Seventy percent of the population and 80 percent of manufacturing in the U.S. is located in that Golden Triangle, which runs from the Great Lakes down to Texas, across to the Southeast, and up through the mid-Atlantic. That region has access to five of the seven Class I railroads and over 20 ports, half of which are deep water.

Seventy percent of the population and 80 percent of manufacturing in the U.S. is located in or near the Golden Triangle, which runs from the Great Lakes down to Texas, across to the Southeast, and up through the mid-Atlantic.

Diversifying port strategy and becoming less reliant on West Coast ports are key foci for major companies, agrees Thompson. Walmart was one of the first major corporations to identify a “four corners” port diversification strategy that brings goods into the U.S. from two ports on the West Coast and two on the East. The company knew it would increase costs, but it reduces the risk of disruption, he says.

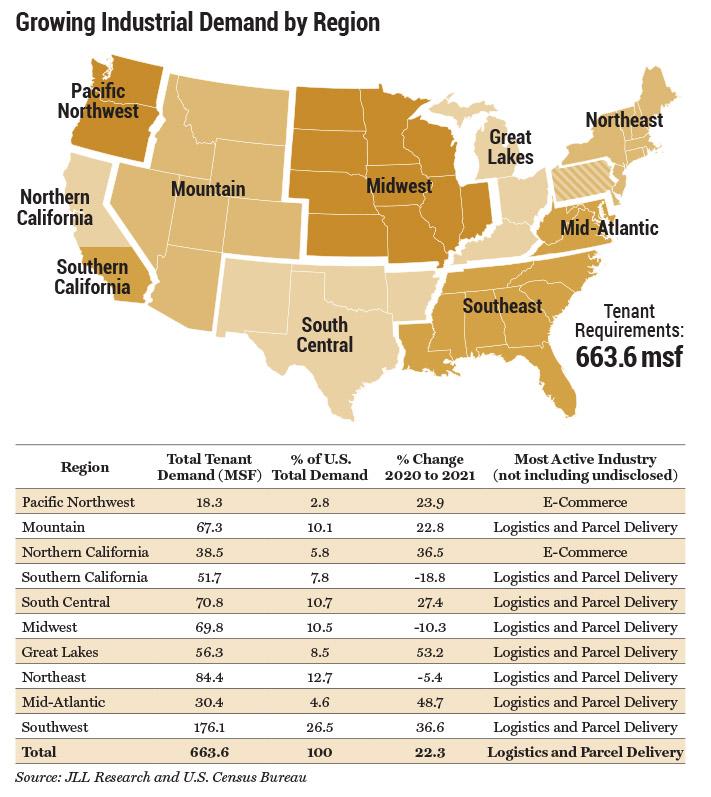

Another strategy impacting location decisions is the regionalizing of supply chains to get closer to the consumer, which is creating a resurgence of manufacturing activity in and around the U.S. with a huge uptick in manufacturing-related projects in the U.S., says Thompson. According to JLL’s Industrial Tenant Demand Study, requirements for manufacturing space jumped to 50.4 million sf in 2021 — nearly double the annual requirements seen in 2019 and 2020. The report noted that the driving factor for the increased demand is companies’ desire to establish a U.S. sourcing presence and a realization that long supply chains are at greater risk of disruption.

On the manufacturing side, the Southeast has always been very attractive because of the labor, incentives, infrastructure, proximity to ports, and the population. “We’re also seeing a lot of the high-tech manufacturing, such as semiconductors, going into Austin and Phoenix,” adds Thompson. On the distribution side, demand for space is starting to spread to secondary and even tertiary markets because companies need to be able to get their goods to consumers faster, within a day or same-day. That is driving demand for distribution in markets such as Denver; Salt Lake City; Charleston, S.C.; and Savannah, Ga., whereas 10 years ago there wasn’t much activity, he says.

Announcements for new manufacturing and other company facilities create anchoring activity that drives demand for commercial real estate, adds Conway. Commercial real estate investors are working to figure out where that anchoring activity is — where are the new plants, where are the new jobs, and where is growth outpacing inflation. “Where metrics are above the rate of inflation, that’s where investors are looking at the opportunity,” he says. Developers and investors are looking at opportunities across the spectrum of property types, including industrial, multifamily, and retail. The one exception where investors are still hesitant is office because of the slow return to on-site work, notes Conway.

Project Delays and Rising Costs

Secretary of Transportation Pete Buttigieg said it best when he described the supply chain problem as “ship to shelf,” notes Jason W. Conway, CCIM, senior director, real estate development at Opus Development Co., in Minnetonka, Minn. “I think it’s going to be at least a three-year issue and probably much longer to get all of those issues aligned and back to normal, whatever that means.” In the meantime, supply chain disruption is creating longer lead times and contributing to higher costs for building materials.

“The biggest impact for us is schedule. One of the first questions clients ask is, ‘When can we get into the building?’” says Jason Conway. In his current role at Opus, Conway is focused primarily on spec industrial development and build-to-suit projects in Minnesota, Iowa, and Nebraska. For example, one of the key materials for developers is roofing. Vendors will quote a price and estimated time of arrival on delivery, but they won’t provide a hard date or guarantee the price until the material is delivered on site. “That rolls downhill to us, and then we try to put together a schedule and lease commencement dates for tenants that need to move in,” he says.

Similarly, tenants are running into delays when they are ordering manufacturing equipment and materials. Opus has one tenant that mounts tires onto rims. The machine they need to do that was delayed by six to eight weeks. They are leasing a new space that is all built out and ready, but they can’t operate because they don’t have their machines yet. “It is this compounded effect with building materials, vendors, and suppliers that are all experiencing the same issue and exponential effects from what’s going on in the entire supply chain,” says Jason Conway.

Steel is another key material that is experiencing long lead times resulting in delays of 90 to 180 days in some cases. Industrial projects that used to have eight- to 10-month timelines are now 10-12 months, with the added caveat that there may be additional unforeseen supply issues, notes Tim With, CCIM, SIOR, a senior vice president and principal at Colliers International in Albuquerque, N.M. “We’re seeing developers that are being more upfront with clients that delivery times are more of a best guess,” he says. Some developers are trying to get ahead of supply constraints by ordering steel well ahead of project start dates.

The shortage of materials also is driving greater interest in redeveloping functionally obsolete buildings. In Albuquerque, there have been recent examples of vacant retail properties that have been repurposed as industrial because of the cost efficiencies compared to new construction, notes With. “We’ve been talking about that repurposing for many years, but now we are seeing more of that happening because of the inflation and the supply chain disruption,” he says.

Managing Client Expectations

Supply chain disruption is creating delays in obtaining a variety of basic building materials ranging from flooring to fixtures. What used to be typically a three-to-four-month schedule for the build-out of an office or retail space has now become six to nine months in many instances, notes Tom Allen, CCIM, president and principal at Cushman & Wakefield | Sage Partners in Little Rock, Ark. The specific materials that are delayed vary from job to job. Some material delays are expected and can be planned around. “There are some delays we learn about midway through the job. When that happens, it causes issues with start dates of leases or closing dates,” he says. Delays are compounding price increases. Allen has seen increases in the cost to build a building or build out a tenant space that have jumped as high as 50 percent.

Industry practitioners are working to keep projects on track and manage client expectations. “It’s important to work very closely with the general contractors, engineers, and architects on what they’re seeing in the immediate time frame so that the CRE professionals can set the expectations with the client very early on in the process,” says Allen. As far as budgeting, it’s important to have a contingency line item for unforeseen cost increases. “We also ask the [general contractors] and design professionals what alternatives are in stock, and whether we should order even before a contract or lease is executed, depending on the risk,” he says.

“Everyone has an understanding of the supply chain being broken, but there is some educating that has to happen continually with these tenant expectations,” adds Keith Bandoni, CCIM, SIOR, a senior vice president and principal at Colliers International in Albuquerque. In some cases, Colliers has had tenants moving into office spaces that are not fully complete because the contractor can’t get the doors they need or the toilets haven’t arrived yet, but the tenant didn’t have a hold-over option at their previous location.

Another challenge when dealing with tenant improvements (TIs) is that contractors can’t hold their prices for more than a two- or three-week period. Even in the few weeks from when a contractor bids the work until a contract is signed, certain materials — whether it is flooring or wall covering — may no longer be available. Contractors are coming back with substitutions to the original work order. They might guarantee their bid only for a day or two. By the time it comes time to sign a contract, significant changes in availability and price may arise. Some clients are trying to minimize their TIs where possible to avoid delays and higher costs. “The bottom line is that you have to be very fluid,” says With.

CRE pros also are increasingly working with contracts that include language and terms specific to supply chain-related delays and higher costs. At the start of the pandemic, force majeure clauses in leases and other contracts were modified to specifically address business disruption and impacts from the pandemic. As supply chain issues started to emerge, parties on all sides of the table began adding new language to agreements to protect their interests. For example, Opus added a separate line item to contracts to deal specifically with roofing, making it clear that it was out of the developer’s control as to when materials would arrive and what the final price would be. “We just have to be open and honest and transparent with clients, because that’s the world we live in today, and people seem to understand that because we’re all dealing with the same issue,” says Jason Conway.