Secure High Loan Proceeds and Non-Recourse Terms

By Peter Tousignant | Summer 2022

CONTENT SPONSORED BY EASTERN MORTGAGE CAPITAL

For experienced multifamily developers, U.S. Department of Housing and Urban Development-insured financing provides a unique solution to secure maximum potential loan-to-cost (LTC) rates on construction financing as well as favorable terms on a project’s permanent debt.

A One-Stop Solution

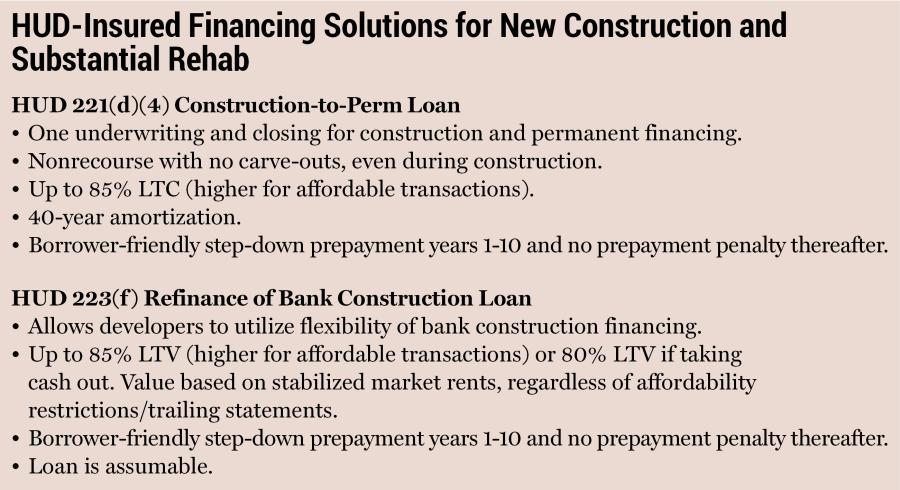

Offering a simple process at attractive rates, the 221(d)(4) construction-to-permanent loan boasts a single approval and closing process, and finances up to 85 percent of project cost — and even higher for affordable projects. Builder and sponsor profit and risk of 10 percent of allowable costs may be utilized as a credit to equity requirements. Third-party expenses and loan costs are also financeable.

Upon construction completion, the interest-only construction loan automatically converts to a permanent loan at the same interest rate as the construction financing with a fully-amortizing 40-year term. This long amortization period supports stronger cash flow and maximizes loan proceeds. The loan can be fully amortizing, eliminating the need for a balloon payment and allowing the borrower to focus on project management without the stress of planning a refinancing event.

Many developers are surprised to learn that HUD loans offer tremendous flexibility in the event of refinance or sale despite being long term in nature. HUD loans feature step-down prepayment for Years 1 through 10 and are repayable without any penalty after 10 years. Unlike many other forms of long-term financing, HUD loans never utilize yield maintenance or defeasance, which can severely limit opportunities to sell or refinance a property. HUD loans are also assumable. Given the loan’s high initial LTC, loan amounts at assumption are more likely to meet a prospective buyer’s equity budget than lower LTC loans.

While some developers appreciate the single step ease of a construction-to-perm loan, others would rather retain the flexibility provided by an established banking relationship during construction and lease-up.

While even well-established developers are often required to post personal guaranties on bank construction loans, all HUD financing is fully nonrecourse with no personal guarantees and no carve-outs to the nonrecourse language. This is true even during the construction and stabilization periods with the HUD 221(d)(4) program.

The fully nonrecourse nature of a HUD construction-to-perm loan does require more processing time than some other types of construction financing. HUD’s underwriting process requires submission of full plans and specs, and it includes deadlines that developers must meet. Project teams must also include a bonded contractor, and it is best if the architect and contractor have experience building projects that are financed with HUD-insured loans.

In exchange for the time and procedure required, the 221(d)(4) provides developers the convenience of one underwriting process and closing, a single 40-year amortizing loan at a highly competitive fixed interest rate, no personal guaranty, steadily declining prepayment penalties, and no limits on rents, tenant income, or return on equity.

The Best of Both Worlds

While some developers appreciate the single step ease of a construction-to-perm loan, others would rather retain the flexibility provided by an established banking relationship during construction and lease-up. Traditional bank construction financing usually calls for a personal guaranty but often offers more freedom with project design, construction contract structure, and change orders.

HUD’s 223(f) permanent financing program can take out bank construction loans with long-term financing on favorable terms nearly identical to those of HUD’s construction-to-perm product. A stabilized project can be refinanced out of its construction loan with a 35-year fully amortizing loan. The loan is fully nonrecourse to the borrower with no carve-outs, features step-down prepayment for 10 years and no prepayment penalty thereafter, and is assumable.

Additionally, the 223(f) allows developers to borrow more than the outstanding construction loan balance. Stabilized projects can be financed at up to 85 percent of appraised stabilized value (higher for affordable projects) or 80 percent with cash out beyond the existing loan balance.

Many developers are surprised to learn that HUD loans offer tremendous flexibility in the event of refinance or sale despite being long term in nature.

Using a 223(f) to refinance a construction loan adds a separate underwriting process and closing to the development timeline. However, the costs of closing the HUD financing can be rolled into the permanent loan, and the 35-year amortization schedule provides cash flow relief to help absorb the costs of a separate loan.

Maximizing Proceeds for Metro Philadelphia Development

The neighborhoods to the north of City Hall in Philadelphia are seeing an exciting level of redevelopment to increase the city’s supply of class A rental housing. Using FHA mortgage insurance, Eastern Mortgage Capital, a leading national lender focusing on multifamily and senior living/health care lending, provided approximately $45 million in construction-to-perm financing for a new project in Philadelphia that includes 108 residential apartments and first-floor commercial space. Why did the developer choose a HUD-insured construction-to-perm loan? In this case, they wanted maximum loan proceeds to leverage opportunity zone equity. Additionally, the loan’s 40-year amortization marries well with the developer’s plans to hold the property long-term. They likely will not hold the loan for its entire term, but want the flexibility to sell or refinance at their discretion without the constraint of a looming balloon payment.

Freeing Trapped Equity in a Growing Market

Developers used a conventional bank construction loan to create 284 units of new apartment housing in the growing market of Rexburg, Idaho. Bank financing allowed the developer to begin construction quickly and have more freedom through the design and construction phases. With rents on the rise in this increasingly popular location, the completed project held significant value that the developers wanted to realize. The HUD 223(f) refinance loan provides up to 80 percent LTV for cash-out refinances. Eastern Mortgage Capital was able to deliver a nearly $27 million loan that features a 35-year fixed rate and requires no personal guarantees from the borrower.

This content was brought to you by Eastern Mortgage Capital. To learn more about HUD-insured financing for multifamily properties, visit www.easternmortgagecapital.com.