MOB Mentality

By Tracy Altemus, CCIM | Summer 2022

Every area of every market in commercial real estate is subject to changing trends large and small — from a small tweak in how people can order retail, for instance, or the complete upheaval of a business model thanks to a global pandemic. But medical office buildings (MOB) are an especially interesting opportunity for developers because of their long-term stability. We will always need medical space. Demographics tell us baby boomers are continuing to enter retirement years, which will require an even greater need for medical services. Even with the widespread adoption of telehealth in the wake of COVID-19, increased consumer demand still trickles down to office visits.

Looking at a specific case study is a great way to start the discussion of what commercial real estate professionals can do to take advantage of opportunities that arise with MOB developments. As with any project that involves millions of dollars and plenty of resources, complexities or unique characteristics in any deal will arise. But answering a few initial questions can help you understand the major factors involved in the early stages of MOB development.

The Case for MOB

For our hypothetical case study, let’s assume Larry Pass, MD, is an internist and Mary Peach, MD, is an orthopedic surgeon. They’re both on staff at a few local hospitals, but Health Co. Hospital has communicated that it would like to bring them aboard in a more meaningful way. Health Co. has excess land on its major campus, meaning a MOB could be built on-site with the two doctors potentially having ownership. For the doctors, the idea is appealing because they are tired of paying rent, and they’re both familiar with other doctors greatly benefiting from owning real estate.

One of the nuances in a MOB development is understanding unique medical concerns such as Medicare rules and the so-called Stark Law, which aims at prohibiting doctors from realizing non-market benefits from a hospital to discourage self-referrals. In addition to helping them navigate the regulatory dos and don’ts, your role as a skilled CRE professional in this area includes helping Peach and Pass get a better understanding of what’s feasible for two professionals in their situation. One of the first questions for the doctors is pretty simple: Would it be better to lease the space or own it?

Medical office buildings (MOB) are an especially interesting opportunity for developers because of their long-term stability. We will always need medical space.

Like first-time homebuyers, Peach and Pass will need to consider economic and subjective pros and cons. How long of an investment do they expect this to be? Are they realistic in their expectations for building maintenance, operations, and management and how would they differ if they lease or own? How long do they expect to practice? Do they expect to have growth needs?

Once they decide it would be beneficial to develop and own the MOB, the doctors then ask what your role, as the MOB development expert, will be in the project. Here, there are two common possibilities — an investor/developer and a fee-based developer. As expected, the investor/developer is a partner with the doctors, where some of the payment comes in owning a piece of the pie, while a fee-based MOB developer is compensated for the time and energy spent putting the project together. That fee, which is separate from any compensation for acting as broker or leasing agent down the line, is agreed to upfront, before the project gets off the ground.

In practice, MOB developers in both roles do much of the same work. In either approach, you will need to agree on a development agreement that will lay out the terms of how decisions will be made and what each party can and will do. This agreement will cover things like hiring architects, attorneys, accountants, and contractors; securing entitlements and zoning approval; creating budgets and a pro forma; securing financing; and deciding on ongoing building management. In addition to this document, investor/developers will also require an operating agreement with the other parties — in this case Peach and Pass — to detail the building ownership relationship because part of the compensation is directly tied to the MOB.

Calculating Opportunity

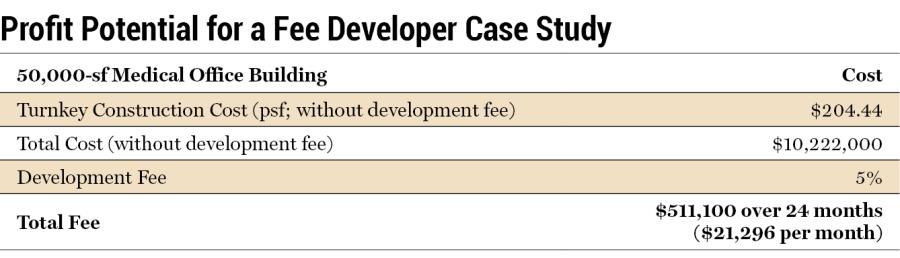

Let’s pencil things out in both cases to see the best path forward for you as the CRE expert in this MOB development. First, let’s examine the fee-based option to see what opportunity for profit is available in a more straightforward MOB. Because you’re getting paid as a function of time, it’s important to understand just how long this project may take. For our case study, let’s assume the acquisition will take three to six months, design will take another three to six months, permitting and bidding will take a month or two, and construction can take from six to 15 months — in addition to the lease-up which will start immediately. For a rough estimate, the MOB development from start to finish will be in the neighborhood of 24 months.

With any medical office development on a hospital campus, you can expect there will either be a ground lease with use restrictions or CCRs spelling out what can and cannot be in the building.

Looking at the first table, if the doctors are looking for a 50,000-sf building at a price just over $200 per sf, a development fee of 5 percent would bring in $511,000, which works out to $21,296 a month for two years. Now, more than $20,000 a month is nothing to dismiss, but a $10 million, 50,000-sf building isn’t a one-person operation. You will need to assemble a team for this development. Think of the accounting alone — it’s much more than sending out a bill for $21,296 for two years. You’ll need to handle the bidding, construction costs, payment authorization, and more. This project will require an accounting team. Someone else must find tenants to fill a 50,000-sf building — and negotiate leases with the renters and the doctors who own the property. Administrative tasks, property management, legal requirements — a MOB development is much more than a handshake deal or two.

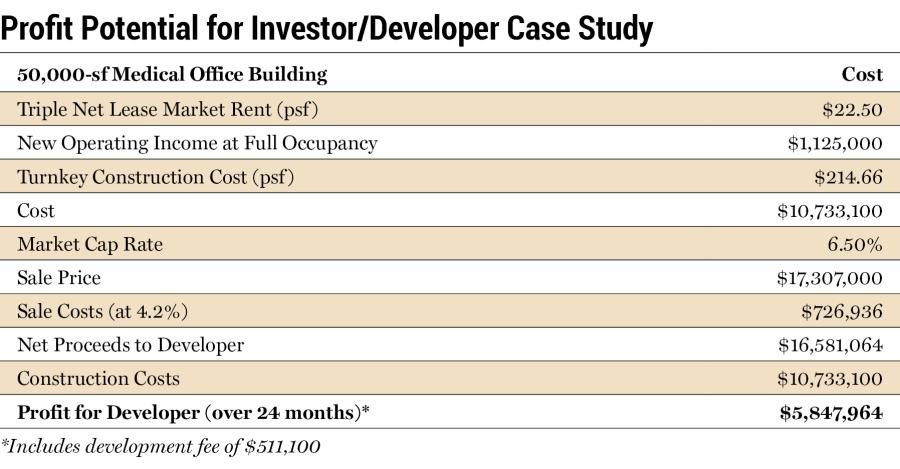

But before throwing up your hands and walking away from the project, take a look at how the numbers work in the investor/developer scenario (in the second table). A market survey shows, with the same 50,000-sf building, a reasonable market rent for triple net leases is about $22.50 per sf. Based on 100 percent occupancy, that means $1,125,000 in annual net operating income. The total cost of the MOB development is $10,733,100. A market cap rate of 6.5 percent, which is consistent with the market, means the estimated sales price would be over $17.3 million.

That’s a pretty impressive figure, but that’s not all going into your pocket. Factoring in sales costs — including commissions, title, escrow fees, and attorney costs — amounts just under $727,000. Subtracting the construction costs of more than $10.7 million means the profit for the developer is $5,847,964, which includes the development fee of $511,100.

But without getting too deep in the weeds of financing, it’s worth asking where to find equity capital. Construction lenders alone may require 10 or 15 percent, meaning that’s at least $1.5 million to get started.

How Much Space?

If coming up with that amount from the start isn’t a possibility, the doctors could look to bring in additional investors to help write checks and get things going. In this investor/developer relationship, it’s important to know what all the invested parties want out of the project. What do Peach and Pass expect from the property? What do they expect from you, as the commercial real estate expert? Do the doctors want to have room for growth? Will they look to lease the remaining space? Or will they allow other investors to buy into the project?

For this case, let’s assume the doctors prefer to offer ownership/partnership with doctors who lease space in the building. Putting the development into an LLC, the doctors plan to use a total of 15,000 sf in the building (and would like to have about 40 percent more space for speculative tenants).

Initially, the doctors have interest from a radiologist (4,000 sf), a physical therapist (2,500 sf), and a urologist (2,000 sf). The Health Co. Hospital has immediate interest in 5,000 sf for office space while committing to another 10,000 sf. That 38,500 sf along with 40 percent more for speculation adds up to about 54,000 sf. But as the commercial real estate professional, you know that if this MOB is going to be on land owned by the hospital, the hospital will need to approve the uses in the building. The hospital would be wary of any direct competition being in the building and would likely exclude those uses. With any medical office development on a hospital campus, you can expect there will either be a ground lease with use restrictions or CCRs (covenants, conditions, and restrictions) spelling out what can and cannot be in the building.

In this case, the hospital has its own radiology practice, so 38,500 sf of committed tenants will shrink by the 4,000 sf of the interested radiologist to 34,500 sf, unless you can convince the hospital to use the 4,000 sf for its own radiology practice. Assuming the hospital does add the radiology, with these agreements, you could have 69 percent (34,500 sf) of the space locked up in long-term leases with the possibility of more investors.

Anyone who has seen a project from initial discussions through to completion knows a lot can happen after this point. But for understanding how medical office buildings can come together and what opportunities are out there for developers, this case study helps as a primer on initial considerations. Nothing is guaranteed about the future, but with growing demand for a sector fueled by demographic trends and global events, MOB development could be an intriguing opportunity.

Editor’s note: This article was adapted from the CCIM Institute course, “Evaluating Medical Office Building Development.”