Proptech's Golden Age

By Sarah Hoban | Spring 2022

While many areas of commercial real estate were slowed or postponed by the COVID-19 pandemic, interest in and incorporation of proptech sped up.

Some of this adoption was an immediate reaction to COVID itself, as owners and operators of commercial buildings scrambled to provide safe, sanitized spaces for building occupants. But the pandemic also exposed areas — and opportunities — where strategic technology use could make a significant difference across the CRE spectrum, from operational savings to tenant satisfaction to improved organizational processes and practices.

Investors were paying attention as well. According to a recent study from Houlihan Lokey, almost $19 billion in growth equity and debt capital was raised in U.S. proptech in 2021 — more than twice the figure in 2020.

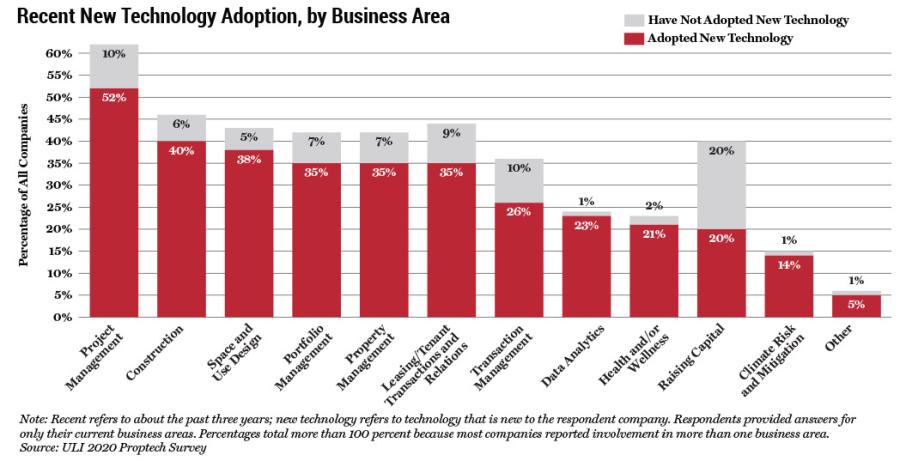

Innovation spurred by the pandemic tended to center around health and wellness, property management, and climate risk and mitigations. According to “Proptech: Changing the Way Real Estate is Done,” a 2021 report from the Urban Land Institute and law firm Goodwin Procter, those three areas ranked highest in new technology adoption as a result of the pandemic. Office building owners focused on areas such as flexible office space to aid social distancing, touchless systems, improved ventilation, and controlled energy use in partially occupied buildings. Retailers also faced health and social distancing challenges, as well as new accommodations for the uptick in e-commerce. The multifamily sector pivoted to offer contactless tours and leasing, with many tenants increasingly focused on healthy and sustainable living areas that were now doubling as workspaces.

But the industry slowdown that COVID-19 initiated also gave practitioners the chance to take a closer look at their overall proptech capabilities. “Some are using the opportunity to experiment with the adoption of technology to get a head start on their competitors when demand returns, as well as be better positioned for the multi-modal future of work,” says Raj Singh, managing partner at JLL Spark Global Ventures, the strategic investment arm of commercial real estate services firm JLL. “However, many organizations have decided to wait and see, with the sentiment that once new standards emerge, they will be able to quickly pivot. Neither approach is wrong, but it’s likely that early adopters of proptech will have an increased advantage if they are strategic in their approach.”

Proptech’s role in commercial real estate can be dizzying in its variety, and the challenges for companies as they move forward are determining what they need, how they’ll benefit from it, how they will obtain it, and how they’ll pay for it. Successful adoption of technology can make a significant difference in companies’ bottom lines, whether through energy savings, construction efficiencies, streamlining processes, or efficient data analytics.

Perhaps the most visible manifestation of proptech is smart building technology, which includes physical components such as lighting, HVAC, and water usage; digital capacity for tenants; customizable features such as work areas that can be reserved; location tracking; and even parking facilities.

In 2021, Forrester Consulting surveyed more than 300 facilities and corporate real estate decision-makers and found that they expected employees back in the office by 2022 and were depending on technology to help them achieve their top goal: creating a workplace that was most conducive to productivity. According to a report on the survey, “close to 80 percent of respondents say their firms have invested or are currently investing in technology to optimize facility management; the same is true for real estate portfolio and data management technology investments.”

And it’s not just concern for current tenants and employees. “We’re seeing in our polling indications that there’s good interest [in proptech],” says John D’Angelo, real estate solutions leader for Deloitte. “People believe that having a smart building, whatever that means, is going to be really important to tenants when they make choices about where to go. It’s along the lines of, ‘The war for talent is over — talent won.’ If you’re an employer of choice, how are you showing that you’re enabling a great experience for your people and helping them be productive?”

He also notes that the increased emphasis on health-related aspects of a building — such as ventilation, air circulation, and natural light — have become more important to tenants. “Before the pandemic, there was an interest in wellness, but it wasn’t very widespread,” he says. “Certainly, it’s a very different story now.”

Smart building technology has also become a factor in companies’ ESG goals. As tenants, customers, and investors examine a company’s commitment to the environment and sustainability, the ability to measure and conserve energy and water, as well as build environmentally sound buildings, can be implemented with smart technology.

Smart buildings can also automate functions such as room booking, hot desking, employee location, and office mapping, all of which can be personalized to occupants. “[H]aving my environment be smart about what I want and anticipate my needs [is important],” D’Angelo says. “I can set preferences and go from one location to another, and it will remember my preferences. I think we’re going to see more of that.”

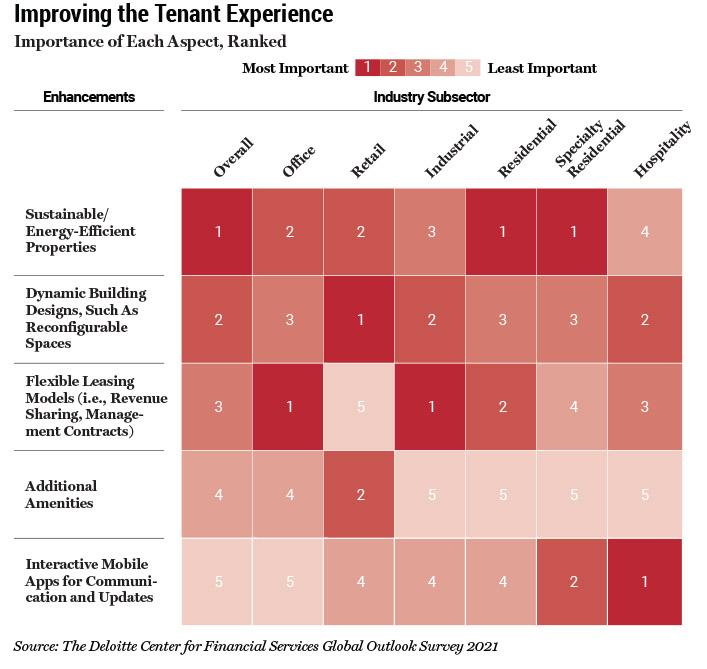

The office environment isn’t the only place where occupants’ expectations have been raised. D’Angelo sees it in multifamily rental properties as well. Renters are looking at a building’s environmental impact and energy use, as well as app-controlled smart home technology in the building and individual units. “We’re hearing that from multifamily rental owner/operators. At one point, these were considered amenities, and I think that’s moving more toward being essentials. We’ll continue to see pressure to have the digital experiences of residents match the digital experiences of other parts of their life, like their financial life. Real estate just can’t be a completely different paradigm than the rest of their world.”

Beyond the Smart Building

But real estate companies need to look past the bells and whistles of smart technology to use proptech as a complete package. Deloitte’s “2022 Commercial Real Estate Outlook” recommends “a shift in mindset in how firms engage with tenants, end users, investors, and developers. Leaders should adopt a Real-Estate-as-a-Service (REaaS) approach, which combines strategy, technology, and data to deliver digital and physical services — not just space — to tenants and users.”

“The most proactive companies,” says the ULI report, “are pursuing multiple business strategies to stay ahead of change and innovation made possible by technology, and to identify and access optimal technological solutions as they become available.”

Companies using project management technology, for example, can connect all participants in a development project — from investors through the contractors — to enable a more efficient building process. Construction technologies focus on construction and space and use design. This can include everything from drone technology during construction, building information modeling, and visualization tools. On the financial end, technology use has increased for forecasting, tenant management, portfolio and transaction management, and raising capital.

One bedrock of proptech is data analysis, which is an area where companies are not yet where they should be. Forrester Consulting’s study showed that many firms were confident in their ability to analyze data, but 62 percent of respondents said their firms lacked the technology to do so, and 65 percent said that collecting real-time data was challenging. That could change — ULI noted that only 46 percent of survey respondents said that they had adopted data analytics over the last three years, but 77 percent said that they have included it in their technology plans for the next three years.

“The pandemic exposed that many commercial real estate organizations lack resiliency, primarily a symptom of disconnected processes and data, which makes it extremely challenging to respond to a dynamic, rapidly changing market,” says Frank Spadafora, real estate principal at DealCloud by Intapp, a vertical SaaS solution firm based in Jersey City, N.J. “Manual, trailing data processes were historically sufficient to manage commercial real estate investments and operations.” But during the pandemic, property managers had to suddenly deal with immediate challenges, like buildings that were running at a 20-percent occupancy level. Multifamily owners needed data on tenant movements and rent analysis. Investment and asset managers, says Spadafora, “had little to no real-time data to inform how COVID-19 was going to impact their portfolio.”

“It highlighted that the outcomes we were trying to achieve lacked the data that we needed to monitor and measure,” he says. “It distilled [data] down into what’s really essential for effective and timely decision making. When [companies] started looking for this data, they realized that their systems and information were often fragmented and disconnected, and they needed a centralized view of this firmwide intelligence. That’s where this fundamental challenge in real estate, to capture and harness this information, was highlighted.”

But the need for integrated data was hampered by the promise of emerging technology. As proptech has heated up, Spadafora says he’s seen clients racing for point solutions such as smart building technology. “They often were focused on individual solutions for functional processes like property management without understanding how that data was going to be integrated into enterprise decision making. It actually created additional challenges of fragmentation by increasing data velocity without the ability to understand and incorporate this new data into firmwide intelligence.”

A property management team might focus on adding technology to one building, “and that certainly helped them operationally, but then they couldn’t integrate that data back into the C suite to make the big decisions about the portfolio. To make those decisions, we need to connect every single building and every property manager across the portfolio.”

This holistic approach, says Spadafora, will mark a separation of a company’s ability to compete. “Those organizations that really focused on a foundational data strategy and governance are now better prepared because they’ve got better speed to execution, they’ve got a more connected workforce, and they can produce the data and analytics the C suite needs.”

Searching for a Solution

The array of proptech solutions makes choosing one challenging. “You talk to companies who are trying to figure out what to pay attention to, and it can just be overwhelming,” says D’Angelo. “This isn’t new; it’s been like this the last half dozen years. But there’s a lot coming at you to figure out, and people can just get stuck. What’s actually promising? What’s real? Where do you place your bets?”

Choosing and integrating an approach requires careful upfront planning, says Spadafora. Strategy and clear outcomes are essential. It’s important to ask questions about what the technology enables. “That forces organizations to look at their internal culture and decision making and where they have the talent and resources among their people and processes,” he says. “Then they can align the technology that’s going to enable outcomes. It’s a methodical process in how you approach that.”

Once they understand the outcomes and the necessary technology, companies have several choices when it comes to developing a fully integrated technology plan. They can develop and implement a plan internally; they can outsource the entire function or partner with a proptech company. “You have to match the solution to your organization,” says Spadafora. “It’s not one size fits all.” Much depends on a company’s understanding of its own internal resources and expertise, and he cautions against automatically outsourcing without first determining those. If the decision leans more toward partnering with an outside group, “you want to look at the provider holistically,” says Spadafora. “It’s not just what the tech can provide, but what can it enable you to do? Could this partner grow with you? What’s their funding like? What’s their client base? Could they be acquired by a larger firm?”

The most proactive companies are pursuing multiple business strategies to stay ahead of change and innovation made possible by technology, and to identify and access optimal technological solutions as they become available.

Spadafora points to another option as well: software as a service (SaaS). These cloud-based solutions can be a good fit for companies that lack the resources to develop or buy larger-scale plans. Because it uses common cloud-based tools, companies can use SaaS to build systems without the overhead or complexity of large-scale in-house development. He points to DealCloud’s parent company, Intapp, as an example. Intapp recently announced a partnership with Microsoft that will allow the company to provide technology solutions leveraging a Microsoft Azure-based industry cloud.

Using SaaS, specific functions and access can be designed for different teams in the company, but now, says Spadafora, “everyone is sharing one common data object across the enterprise.” The vertical cloud, he adds, is like a backbone. “It can be a single point of repository for data, but it can also interface with other internal systems that may store critical data.”

Moving Forward

How should companies best proceed as they develop their own proptech solutions? “Real estate professionals should continue to read up on what’s changing in proptech and stay curious,” says JLL Spark’s Singh. “Building strategic frameworks and making technology-based decisions within them, as opposed to buying point solutions, will help overcome adoption barriers.”

D’Angelo’s advice is similar. “As an individual company trying to figure out which is which, what do you look for? You look around and say, ‘Who else is doing it?’ Some of that is dictated by how progressive a company wants to be in being technology driven or being early adopters, but I tend to see those companies with focused resources really looking at the landscape of what’s emerging. But some will wait and see simply because of resources.”

D’Angelo is optimistic about burgeoning proptech. “I hope we’re going to look back on this and see it as a tipping point — that this is when it was no longer optional,” he says. “That owners, operators, developers will do this because that’s what it takes to have a relevant asset in a given marketplace. We could see a golden era. To enable a better occupant experience, to better understand what’s really happening in a building, to run a more efficient building — there will be a wave of both investment and innovation in real property technology.”