Consumer Sentiment and the Industrial Sector

Much of the focus around the industrial sector is on the impact of manufacturing, heavy industry, and the sector’s role as an intermediary for goods storage before they reach their final point of sale. Increasingly, however, transactions are taking place in a manner that bypasses brick-and-mortar retail altogether, which has been a boon for the industrial sector. From the data centers housed in flex/R&D space that power the completely digital nature of e-commerce transactions to the warehouse/distribution space that stores and dispatches the items to consumers, the sector’s growth and strength are due, in large part, to the exponential rise of e-commerce over the past decade, aided by the shock from the COVID-19 pandemic.

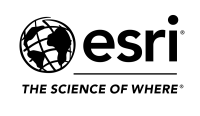

To capture the effects of shifting consumer behavior, an important metric to consider is the e-commerce share of total retail sales. This percentage meaningfully impacts the industrial sector, because e-commerce requires a larger amount of warehousing and distribution square footage than traditional retail due to inventory, packaging, and shipping requirements. E-commerce sales increased by nearly 40 percent from the 1Q2020 to 2Q2020 because consumers had no alternative to buying online in light of the pandemic. As a percentage of total sales, online retail now amounts to 14.5 percent as of 2Q2022, the most recent quarter of available data. This figure is lower than the historical peak of 16.4 percent in 2Q2020, but still a notable gain from the first quarter of 2020, when it stood at 11.9 percent, the highest figure until that point.

While on the surface it may seem concerning that this metric has been trending downward since its peak, this is more likely an indication that this variable is returning to its original growth path after experiencing an exogenous shock. Nonetheless, e-commerce is likely to continue its growth over the coming years, with the potential to reach 20 percent of the market share of total retail sales by the end of this decade.

Retail sales have been on the rise since the second quarter of 2020, experiencing a structural break from their original growth path, leaping upward to a new, elevated growth path. However, high inflation has contributed in part to the sustained increases in spending observed as consumers are paying substantially more now than they were pre-pandemic for the same basket of goods — all stemming from a multitude of factors including supply chain pressures. Sales across all sectors have been strong in the past few months, however, indicating a willingness for consumers to spend.

Although retail sales growth has been consistently positive in the first half of this year, the University of Michigan’s Consumer Sentiment Index reveals a disparate trend. Trending on a sharp decline since mid-2021, consumer sentiment reached an all-time low reading of 50 in June — due to inflation concerns, rising interest rates, and negative, albeit mild, real GDP growth in the first half of 2022. (For context, monthly surveys of the consumer sentiment index date back to January 1978. Prior to that, the data on a quarterly or semi-annual basis extends as far back as November 1952.) Since its historical low in June, consumer sentiment recovered slightly to 58.2 in August.

Nevertheless, consumer sentiment remains lower than it was in April 2020 (71.8), indicating that sustained high inflation has eclipsed public health uncertainties.

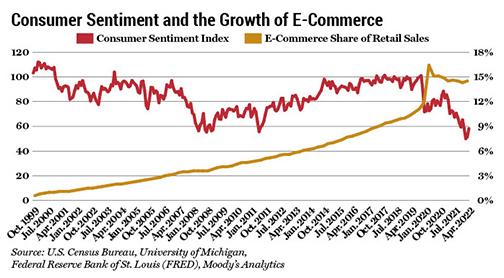

Such lukewarm consumer sentiment points to the possibility of a slowdown in consumer spending on the horizon with the potential to be very consequential for the warehouse/distribution sector. Factoring in expectations by Moody’s that have revised real GDP growth downward to less than 2 percent in both 2022 and 2023 as well as rising interest rates in a bid to tackle soaring inflation (that also raises the cost of borrowing capital), the goods trade is likely to face downward pressure in the latter part of this year and into next, which will directly impact demand for distribution/warehousing properties.

The sector’s fundamentals, however, remain positive. Vacancy rates for warehouse distribution properties have fallen 170 basis points in the first half of 2022 and are projected to decline further, with vacancy reaching a record low of 4.7 percent by the end of the year. Similarly, the completions pipeline remains quite healthy with a total of over 200 million square feet expected to come online this year to partly satiate demand, which is projected to top 333 million square feet.

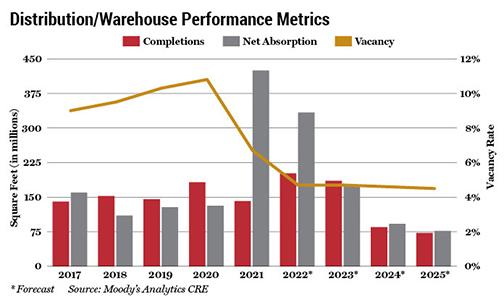

While next year’s projected figures for completions and net absorption will not reach the record-breaking heights of 2021 and 2022, they remain elevated compared to historical averages, with occupancy expected to stabilize. Evidence from the capital markets paints an equally positive picture, with the percentage of loans 60-plus days delinquent in the industrial sector consistently below 1 percent (and on the decline) for the past 18 months. Among the core five sectors, industrial delinquencies have consistently been the lowest, even prior to the pandemic. Despite leading indicators suggesting the possibility of headwinds for the sector, the outlook remains quite bullish for the sector in terms of both occupancy and rent growth, and deservedly so.