CCIM Connections

The Official Publication of The CCIM Institute

Image

Spring 2024

Cover Story

Shattering Ceilings - Leading with Innovation and Industriousness

Read ArticleImage

Spring 2024

Why Now Is the Time for Doctors to Cash Out of Their Buildings

By Michael Campbell, CCIM

Once considered a subsegment of office properties, medical office buildings have come into their own over the past decade.

Read Article

Once considered a subsegment of office properties, medical office buildings have come into their own over the past decade.

The Latest Trending Articles

Featured Articles by Issue

Stay Up to Date on All Issues

Hero image

Intro Text

Did we get to see you in-person in 2023?

Hero image

Intro Text

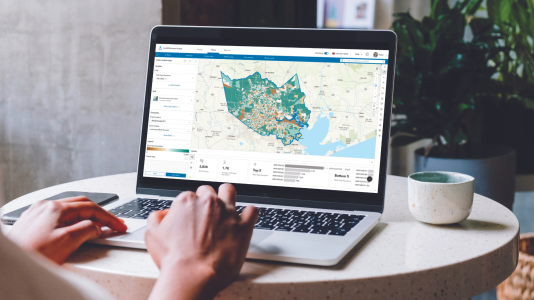

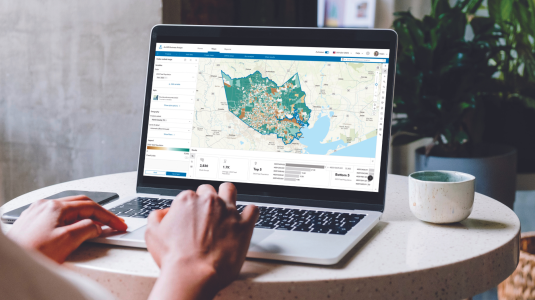

Site To Do Business is commercial real estate's most advanced digital toolkit providing essential data components and marketing tools to give your audience a broader perspective on today's market. By integrating quality online data into a dynamic mapping environment, Site To Do Business provides access to technologies and databases that wins business.

Hero image

Intro Text

Making Deals - Spring 2024

Hero image

Intro Text

Bringing Success and Strength to The CCIM Institute